The problem

-

In Colombia, one in four citizens borrows from loan sharks called “Gota a Gota” to meet their immediate needs, such as paying bills, healthcare or short-term projects, since the traditional banking system does not offer alternatives for those with no credit history or low income.

-

These illegal loans have caused economic, social, and even public health problems. The interest rates are up to 30% and 50% per month and collection methods are often violent and dangerous.

-

The “Salvavidas” (Lifesaver) and the "Propulsor" (JetPack) are two low-cost loans co-designed with users to “save” and "impulse" them when their income is not enough or when they cannot access to formal banking entities. Additionally, it seeks to mitigate illegal loans, providing higher rates of public and economic security to those who borrow.

-

The Lifesaver was the first version of these loans, allowing to borrow between US$30 and US$200 with one month payment period. The JetPack was the evolution, with higher terms and disbursement amounts. Both are disbursed in less than 5 minutes without requesting documents or co-debtors and with low interest rates and zero additional costs.

The solution

Finacle Client Innovation Award 2020 winner

My role

UR

User research: study of the reasons for illegally borrowing in families with low incomes.

UXR

User experience research: design and test of different prototypes to find the components the loans should have to be validated as an inclusive alternative.

UX

User experience final design to have an MVP in production.

Design process

H

Hear

U

Understand

C

Co-create

D

Deliver

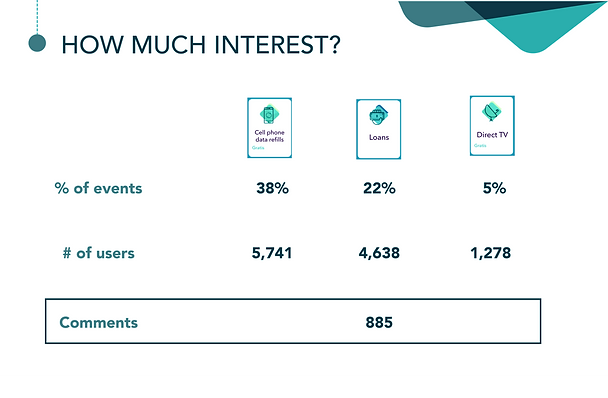

Initial Fake Door

H-U

To validate the idea in short time we developed a fake door input. It was useful to measure interest before starting a complete research and implementation effort.

We also collected some user information to communicate when releasing.

It was the second event that users came to in the app and we received a lot of valuable comments to continue to the research step.

Benchmarking

The objective of this stage was to recognize other digital loans offers that were presented as alternatives to the traditional ones. That way we could understand what was missing and make it happen.

U

C-D

Co-design / User Testing

I conducted some focus groups and interviews with more than 15 potential users, in two of the principle cities of the country. Some of the users had used the app and some hadn't.

The aim objective of the activities was to discover new ways of presenting this type of loans and to test a digital experience of disbursement and payment that could get to different user segments.

In the beginning, we tested two different prototypes to validate the efficiency and the permanence time on the screens. That way we figured out the hot spots and the best UI and UX patterns for the products.

Then we provided users with a form to draw and describe their ideal loan, based on what they had experienced before. They had to put a name on it and tell us the meaning.

We tested the initial graphic communication and language and talked about all the scenarios to create a real journey when lending and borrowing money.

Some insights

U

2

They preferred payment frequency for users was directly related to the frequency of their salaries or incomes.

1

Users perceived that each loan resolved different needs:

Lifeguard: "For immediate needs”, "For short-term things, something daily", "I ran out of salary"

JetPack: "It is a long-term thing”, "to pay university", "For investment"

3

79% of users forget their payments, so automatic payments were valuable as long as they could always change that action.

"My friend Susan forgets everything"

"Take the money from my account, that saves me the effort”

4

For 60% of users the greatest motivation to pay on time was to avoid negative credit reports and being able to have positive credit reports to build a good credit history. And reminding users about their next payment reflected in a lower non-performing loan (NPL) ratio.

5

An important emotional engagement to promote good borrowing and payment practices was to ask and constantly remind users of their reasons of borrowing; their purposes.

H-U

Lean UX

We worked with engaged users, the technology team, legal, service, and other departments and teams to obtain feedback as early as possible to start all the Back-End, Middleware and CX we required to have a great time to market with these products without leaving aside the user centered statement.

Stakeholders mapping

U

To design non-traditional loans is a big challenge, so to be sure we had all covered, we had to create a stakeholder map in which we considered the processes we had to connect with the big bank that was supporting the legal and financial operations. We also considered an insurance company to protect the money of our users.

The results

Wireframes

C-D

Here are some of the wireframes that came up after the analysis of the research and design process announced before.

Flow/Blueprint

Here is the visual diagram that explains how a this product works, the processes and components that are linked to each

other.

It shows the relevant departments involved in the implementation and all the key data we collected.

Lifesaver Blueprint

JetPack Flow

D

Concept

C-D

The names and concepts of these loans are a result of the understanding of users' financial life and ideals or aspirational ideas.

They expected one of the loans could help them to immediate needs and events and the other as a first impulse to start a life project.

The image is just a small part of the graphic piece we created to explain the concept, you can see the details in the bottom below.